Businesses always need to focus on retaining more customers to ensure higher and long-lasting growth. This makes sense. Say you're onboarding 50 customers every month. But if 80 customers are churning, you might as well shut up shop.

So what is customer retention? Simply put, it is the number of customers you are able to retain and is calculated as:

[(CE - CN) / CS] x 100

CE = number of customers are the end of the period measured

CN = number of new customers during the period

CS = number of customers when the measured period began

Key takeaway: SaaS companies need to step up their customer retention game in addition to working on their customer acquisition strategy.

That's not all. Pandemic or not, businesses will also need to laser-focus on selecting the correct (and different) metrics to measure retention success to see if they're heading in the right direction.

This brings us to the most important question:

What is a good retention rate for SaaS?

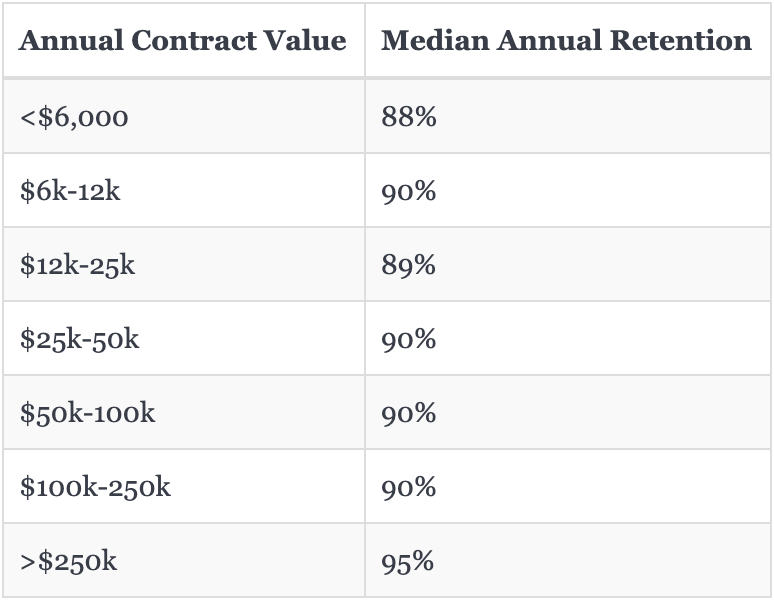

A “good” retention rate depends on the size of your company's target audience. The greater your customers, the higher the retention should be. It's as simple as that. If we were to give you absolute numbers (by annual contract), the 2020 SaaS Retention Benchmarks for B2B Companies report cites varying levels of retention, depending on the annual contract value:

Additionally, according to other estimates, SaaS companies that sell to small and medium businesses (SMBs) should have a Net Retention Rate of 90%, whereas SaaS companies that sell to enterprises should have a retention rate of 125%. Another report suggests that for the SaaS industry, over 35% retention is considered elite.

At the end of the day, you need to remember that the retention rate is indicative of your current and future revenue. Also, note that the higher your retention rate, the lower your churn rate will be.

Now that we have a basic understanding of what customer retention rate is, let's look at how you can calculate it. In this blog, we will look at the top 7 customer retention metrics that you should pay attention to and understand useful tips on how you can improve them.

12 Customer Retention Metrics That Are Central To SaaS Growth

1. Customer Retention Rate

Who this is for: This is for any SaaS business owner that wants to know how many customers stay with a company versus churning. It’s arguably the most fundamental customer retention measurement and should be part of every retention strategy.

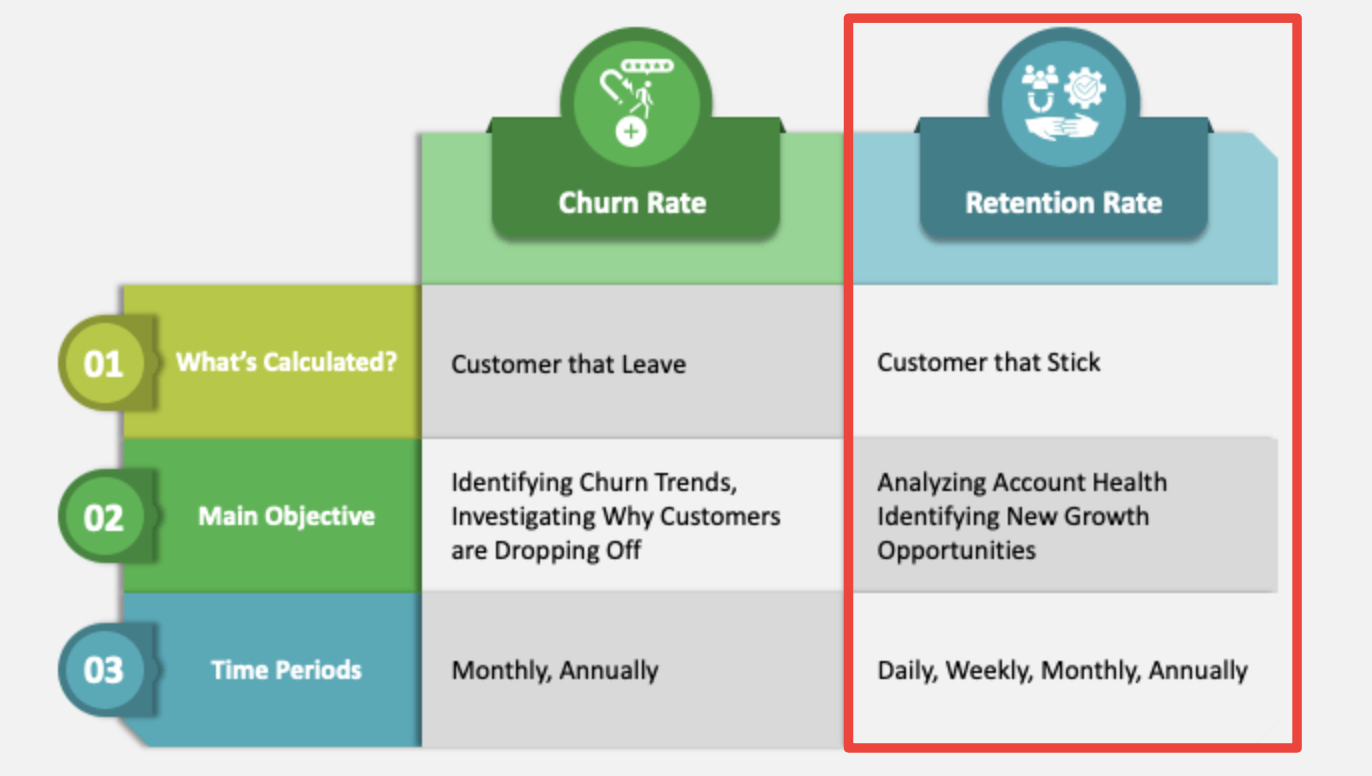

Source: SketchBubble

Source: SketchBubble

What is it, and how is it calculated? Customer retention rate (CRR) is the formula that shows you what percentage of your existing customer base remain as customers after a given period.

Here’s what the formula looks like:

CRR = (Customers at the end of a period - new customers) / Beginning customers

Tips for improvement:

- Continually enhance your customer service to provide the best experience possible.

- Make proactive customer outreach and communication a core part of your retention strategy.

- Resolve customer issues promptly.

- Seek customer feedback to identify and eliminate inefficiencies.

2. Customer Churn Rate

Who this is for: Any SaaS business owner that wants to know how many customers they lose during a period of time will want to calculate customer churn rate (CCR).

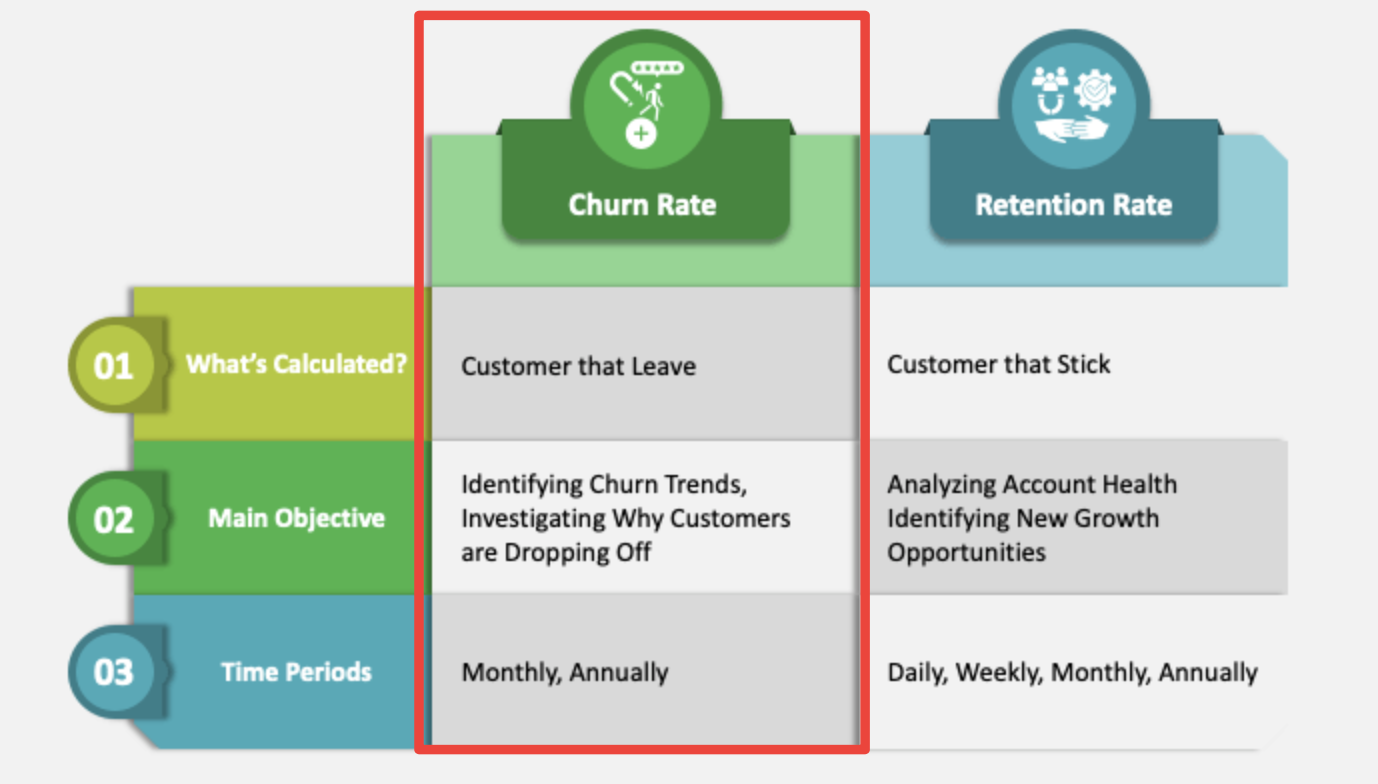

Source: SketchBubble

Source: SketchBubble

What is it, and how is it calculated?

CCR is the percentage of customers that stop using a product after a given period.

It’s calculated as follows:

CCR = (Lost customers during a period / total customers at the beginning of a period) x 100

Tips for improvement:

- Don’t just focus on new customer acquisition and customer acquisition cost, but long-term customer success and boosting your loyal customer rate.

- Identify the specific reasons for customer churn and find solutions

- Continually refine SaaS onboarding (23% of average customer churn can be attributed to poor onboarding).

- Personalize the user experience.

- Find “at-risk” users with low customer engagement and reach out to them.

3. Revenue Churn Rate

Who this is for: While customer churn rate focuses on the percentage of lost customers, revenue churn rate focuses on lost recurring revenue.

Source: Baremetrics

Source: Baremetrics

What is it, and how is it calculated? Revenue churn rate (RCR) is how much recurring revenue is lost from existing customers over a given period.

RCR = (Lost recurring revenue over a period / total recurring revenue at the start of the period) x 100

Tips for improvement:

- Work to demonstrate SaaS value, as well as continually add new features, upgrades, and so on to increase value to raise your customer satisfaction score.

- Provide exceptional customer support.

- Regularly check-in with customers to make sure they’re happy and if any pain points need to be addressed.

4. Repeat Purchase Rate

Who this is for: This is for SaaS business owners that want to measure customer satisfaction and loyalty by calculating how many customers make a repeat purchase. Because of the clear correlation between retention and loyal customers, repeat purchase rate (also known as repeat purchase ratio) can provide a baseline reading of what your loyal customer rate is.

It can also play a key role in maximizing customer purchase frequency.

Source: CartStack

Source: CartStack

What is it, and how is it calculated?

Repeat purchase rate (RPR) is the percentage of customers that purchase more than once within a given time period.

RPR = (Number of customers that buy again / total number of customers) x 100

Tips for improvement:

- Strive to provide customers with great value and A+ customer service to create more loyal customers and boost your repeat purchase ratio.

- Offer personalized SaaS product recommendations based on customer behavior and preferences.

- Keep customers in the loop about new SaaS products they could benefit from to maximize your repeat purchase ratio. Source: CartStack

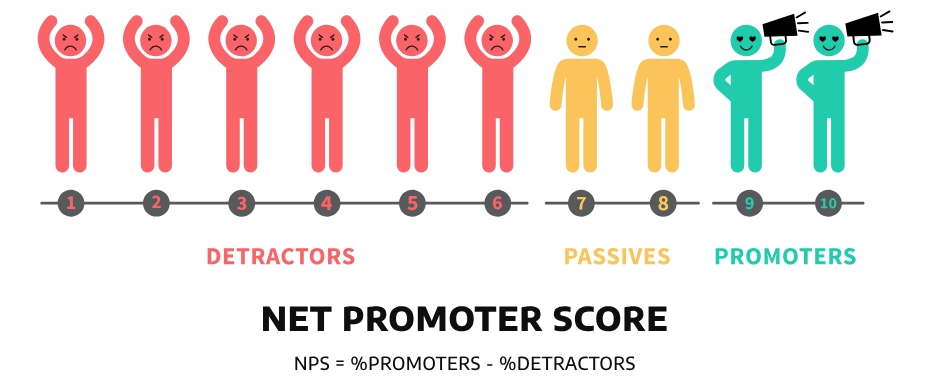

5. Net Promoter Score

Who this is for: Net promoter score (NPS) is a great retention metric for anyone who wants to measure customer loyalty and customer satisfaction, specifically by determining the likelihood that a customer would recommend a product to others.

You can think of it as a straightforward customer satisfaction score and as a way to quantify exactly how pleased a loyal customer is.

What is it, and how is it calculated? Typically, the net promoter score consists of a simple question that asks existing customers to rate how likely they would be to recommend a product to someone else on a scale of 0 - 10.

Source: Churn360

Source: Churn360

NPS = Number of promoters / number of detractors

Tips for improvement:

- Establish a customer loyalty program.

- Proactively address problems and make product improvements based on customer feedback to raise your loyal customer rate.

- Reach out to detractors to determine specific reasons for their dissatisfaction, and look to improve their experience to create more loyal customers across the board.

Optimize for Conversion & ROAS Now! Explore Woopra in a demo and enjoy a 2-week free trial: https://www.woopra.com/demo

6. First Call Resolution (FCR) Rate

Who this is for: If you wish to understand whether your team is well-equipped and efficient enough to cater to your customers, the first time they get in touch with you, this metric is for you.

Source: SQM Group

Source: SQM Group

What is it, and how is it calculated?

The FCR metric is a measure of customer satisfaction and allows you to analyze how your contact center is being able to solve your user's problems, queries, and needs during the first interaction. If there is no follow-up or escalation, your FCR rate should be good. According to reports, a good FCR rate lies anywhere between 41-94%.

Here's the formula on how to calculate it:

FCR = Total number of calls resolved on first attempt / Total number of calls received

Tips for improvement:

- Get to the root cause of the low FCR rate, which in turn, will help you to identify common issues, inefficiencies, and knowledge gaps. You can look at the existing data, call logs and recordings, customer feedback, and speak to your agents.

- Build an informative, organized, and in-depth knowledge base that allows customers to self-serve. Asana is a good example of a company that does this well.

You can also include articles, video explanations, and tutorials.

- Integrate an intuitive live chat software into your website so that your customers can reach you instantly and effectively.

Live chat allows you to drive real-time conversations with your customers and offer speedy, reliable support. It also allows you to analyze your customer's behavior and anticipate their needs.

Drive post-call surveys about the customer experience and provide effective agent training. Here's how organizations typically analyze FCR, according to a recent study.

They asked the study participants “How do you measure First Contact Resolution?”

- 39% answered “We don’t measure First Contact Resolution”

- 13% answered “Post call survey”

- 15% answered “Repeat contact reasons in CRM system”

- 24% answered “We ask the customer”

- 28% answered “No repeat calls in a given time frame”

Key takeaway: There's no templatized formula that can be used to boost your FCR rate. You can use a heady mix of the right tools and strategies to ensure a seamless, instant, and effortless first-interaction experience for your customers.

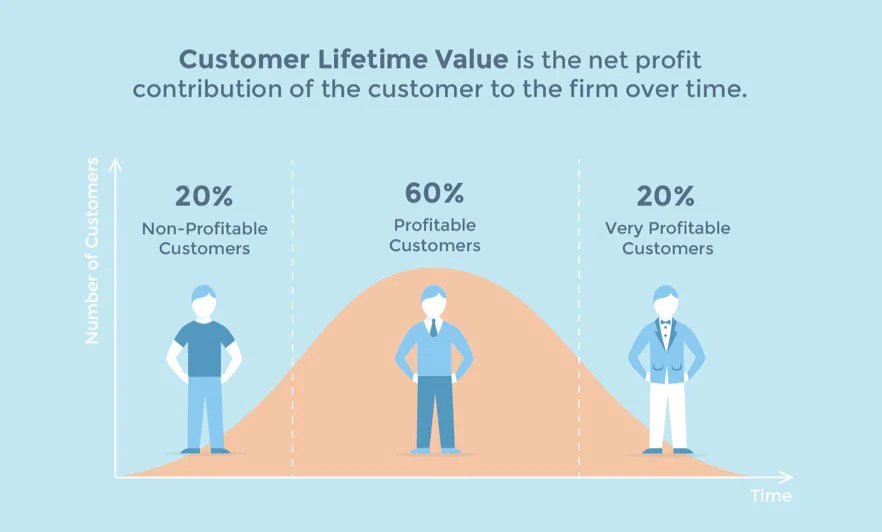

7. Customer Lifetime Value (CLV)

Who this is for: For businesses looking to evaluate how their customers will spend on your brand throughout their lifetime as a paying customer.

Source: Popupsmart

Source: Popupsmart

What is it, and how is it calculated?

In the SaaS domain, different customers can have different CLV as the pricing tiers vary. Hence, calculating CLV for every segment becomes all the more important. In terms of the definition, CLV signifies a customer’s value to a company over a period of time. Here's a simplified formula to calculate it:

Simple CLV: (Annual revenue per customer x Customer relationship in years) - Customer acquisition cost

Tips for improvement:

- Enhance your onboarding process by making use of videos, GIFs, product screenshots, and live chat.

Additionally, ensure that your onboarding process is short and focused:

- Focus on building clear and easy-to-access documentation resources, which allow users to find value in your product and answers their questions easily and instantly

- Gather real-time feedback and act on relevant inputs to consistently improve the customer experience. You can send NPS surveys to get a pulse of how your customers feel about your product/service.

Pro tip: You can generate more product reviews by asking users who have marked 9 and 10 on the NPS scale to rate you on one of the review websites such as Capterra or Trustpilot. This can be done by setting up a trigger in your form that will redirect users to a new personalized screen with a link to a review website and a personalized message. You can also remind about leaving a review by sending an email right after your user has left a high grade on the NPS test.

- Make sure that your product is always improving by releasing new features and updates, and informing customers about the same in real-time.

- Drive pricing and product personalization to boost the overall customer experience:

Key takeaway: CLV is not just about understanding 'how much' customers are willing to pay for your product/service. It is also indicative of your customer's expectations and the quality of service that your team is providing.

8. Repeat Customer Ratio (RCR):

Who this is for: SaaS businesses, who wish to evaluate the overall customer experience and grasp how much value their customers find with the product/service.

Source: Shopify

Source: Shopify

What is it, and how is it calculated?

In simplistic terms, repeat customer ratio represents the number of customers who made at least two purchases during a specific time period. There's no benchmark for understanding what a good repeat customer rate is as numerous factors can impact it. That said, in the eCommerce world, if you have 25-30% returning customers, your business is doing well.

Here's the formula to calculate the repeat customer ratio:

Repeat Customer Rate = Sun Total of Repeat Customers who Purchased 2+ Times / Sum Total of Paying Customers Who Purchased 1+ Times

Alternatively, it can be calculated as:

Repeat Customer Rate (%) = No. customers who've purchased before / Total no. customers] × 100

Tips for improvement:

- Identify which product is getting to you repeat orders and promote it aggressively to your existing customer base.

- Roll out targeted and specific campaigns to rope in customers with high repurchase rates and boost revenues.

- Work towards segmenting your customer base into varied categories depending on their needs and preferences. Then, strategize and send targeted email campaigns/newsletters to retarget users with tailor-made messaging. Provide incentives such as free demos/trials/whitepapers/ebooks/how-to guides/posts etc. to encourage customers to continue purchasing.

Key takeaway: Repeat purchase customers can act as a treasure trove of information, providing invaluable insights into what's working for your brand and what's not. This data can then be used in your marketing campaign and help drive user-friendly improvements like easier checkouts, lower pricing models, etc.

So analyzing your repeat customer ratio is essential from the customer's as well as the business' standpoints. It is also a great indicator of customer loyalty.

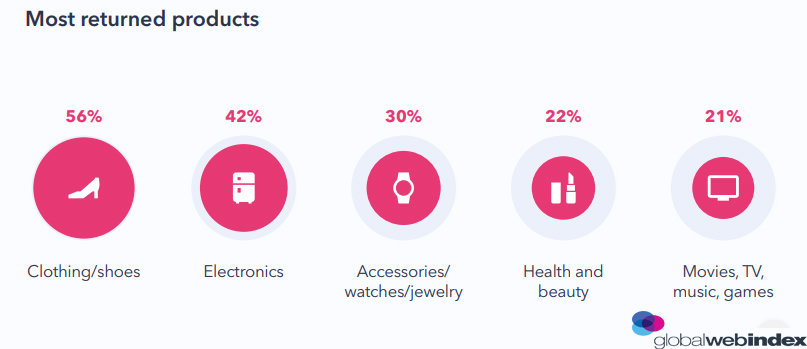

9. Product Return Rate

Who this is for: Companies that sell tangible products as opposed to services/subscriptions.

Image: Digital Marketing Community

Image: Digital Marketing Community

What is it, and how is it calculated?

It refers to the total units sold that were sent back to you. Ideally, as you might have guessed, your product return rate should be zero. Here's the formula to calculate it:

Product Return Rate = Number of Units Sold That Were Later Returned / Total Number of Units Sold

Tips for improvement:

- Ramp up your customer service efforts to understand what your customers do not like about the product.

- Make sure to drive real-time feedback surveys and work on the suggestions to continuously improve on your offering.

- Keep your sales, marketing, and CX teams aligned at all times, with respect to the customer's needs, wants, and issues.

Key takeaway: This metric allows your customer support team to justify the internal customer improvement initiatives. Plus, it allows agents to communicate to teams about where the product might be lacking or what the customer's pain-points might be (with respect to the product).

10. Days Sales Outstanding (DSO): The Most Important Financial Metric

Who this is for: Businesses who wish to understand the efficiency of their financial team and its collection process.

Source: Investopedia

Source: Investopedia

What is it, and how is it calculated?

This metric calculates the average number of days it takes for a sale to convert to monetary cash. In simpler words, it refers to how long it takes for your customers to pay you. Here's the formula to calculate DSO:

DSO = (Average A/R / Total Credit Sales) x (Number of Days)

An example would look like this:

DSO = ($33,750 / $67,500) x 60 days = 30 days

According to reports, Microsoft has a DSO of 57.86.

Tips for improvement:

- Collect payment upfront to the extent possible.

- Offer multiple payment options to your customers--ranging from credit cards to eChecks. Remember, convenience is key.

- Automate your payment process from start to finish, and keep it organized. This allows the process to become seamless and simplified, saving your customer valuable time and effort.

Key takeaway: This metric highlights your company's financial ability to continue operations and scale (if need be). It also allows you to understand how much cash/liquidity you have first-hand.

11. Monthly Recurring Revenue (MRR) Churn: The Primary SaaS Benchmark for Product Development

Who this is for: It is ideal for subscription-based SaaS companies who wish to understand how many subscriptions were lost in each payment period. Accurately measuring MRR allows you to:

- Target business goals

- Create data-informed business intelligence

- Create a reliable monthly budget

What is it, and how is it calculated?

The MRR metric helps you to measure how much of your recurring revenue was lost due to cancellations and non-renewals. Here's the formula for it:

MRR = Total number of active customers X Average billed amount

Tips for improvement:

- Make sure that your product is not underpriced.

- Upsell to your existing customer base and offer product suggestions that are of real value to the customer.

- Engage in per-user pricing and tiered pricing so that when customers upgrade, your revenue per user also skyrockets. Slack is a company that does this well.

- Engage in usage-based pricing. Heroku or Amazon Web Services are great examples here.

- Offer users a time-limited free trial as SEO software Mangools does (instead of offering completely free plans).

Key takeaway: Tracking MRR allows you to drive data-driven product strategies, understand how well your company is doing, and what steps you should take to improve the retention rate.

12. Monthly Active Users (MAU): The Ultimate Engagement Metric

Who this is for: Businesses that work with a freemium model.

What is it, and how is it calculated?

As the name suggests, monthly active users throw light on the number of active users who use your product/service within a month. The higher the number, the greater your customer growth will be. MAU is typically calculated along with understanding the Daily Active Users (DAU) to understand how sticky your product is. Here's the formula for the same:

Stickiness ratio = DAU / MAU

Tips for improvement:

- Always define what attributes to be an 'active' user.

- Make sure to define an “active” user when they engage with your product and have derived undeniable value.

Key takeaway: It enables SaaS companies to understand the value of 'each customer' and the overall health of the company's customer base. It also demonstrates your revenue growth and potential.

Wrapping Up

SaaS marketers today know that one of the sure-fire ways to ensure growth is by focusing on retention. And while it may seem daunting to get your head around which metrics to pick, it's well worth the effort.

All in all, improving customer retention and decreasing churn should be every SaaS business's priority.

So try these 7 customer retention metrics outlined above and make data-informed decisions relating to core areas of your SaaS business, such as identifying the key initiatives, selecting the appropriate marketing channels, undertaking the right mix of sales efforts, and ensuring timely and relevant product enhancements.